New Jersey DGE: No Interstate Compacts on Horizon

Since even before any states legalized and regulated online poker, there was talk about the need for states to band together and form interstate poker compacts to increase their player pools. As Benjamin Franklin said (almost assuredly thinking about online gambling), “We must all hang together, or assuredly we shall all hang separately.” But not only are all three states that currently have internet gambling regimes – Nevada, Delaware, and New Jersey – still ring fenced from each other, it does not look like the largest of them is going to do much of anything about it at any point in the near future.

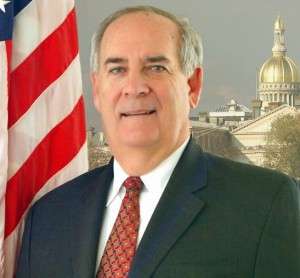

According to an article by AP writer Wayne Parry on Philly.com, New Jersey wants to expand its player base outside of its borders, but it is a slow, slow process. David Rebuck, director of the New Jersey Division of Gaming Enforcement (DGE), told Parry that his and the state’s goal for the coming year is to boost the player pool, specifically mentioning poker. He said that he has been in talks with Nevada and the United Kingdom about letting players from one jurisdiction play on sites from another, but talks are as far as things have gotten. Nothing is on the horizon.

The thing is, New Jersey’s online gambling industry could probably survive without any compacts. Though its first year (Wednesday is the one-year anniversary of online gambling’s launch in the state) has been disappointing, with just $111 million in revenue brought in by the gaming sites compared to an initial projection of $1 billion, New Jersey likely has a large enough population to sustain a handful of sites. With an estimated 8.9 million residents, it is the 11th largest state in the U.S. And even though actual results fell way, way short of estimates, the revenue injection has helped some of the brick-and-mortar casinos who offer the games. In a year in which four Atlantic City casinos (Atlantic Club, Showboat, Revel, Trump Plaza) have closed and one (Taj Mahal) is about to, any extra cash flow is welcomed.

Nevada and Delaware are the two states that really need to team-up with New Jersey or another country. Nevada has just 2.8 million residents and is barely seeing more than 200 cash games players visit its site on average in any given day (thank you to PokerScout.com for the traffic numbers). Ultimate Poker, the first regulated online poker room to go live in the U.S., just closed up shop in Nevada, not long after exiting New Jersey, partially blaming the small player pool for its demise. Delaware has three online gaming sites, but even combined they can barely be seen on the internet gambling radar.

David Rebuck

In February, the governors of Nevada and Delaware did put their signatures on the “Multi-State Internet Gaming Agreement” which will allow the two states to share player pools, but that bird has yet to take flight. Nevada might not see much of a boost from it, anyway, considering Delaware’s player base is so small. The two really need New Jersey to see a boost. It appears that 888’s All American Poker Network will be the first to bridge states; it has already announced it will launch its network in Nevada with a new 888 site, a site from the Treasure Island casino, and WSOP.com, which already uses 888’s software. The three online casinos in Delaware also use 888’s software and will combine with the Nevada sites to make a six-room network. It is unknown when that will start.

Back to New Jersey, another way New Jersey may be able to increase its player pool, the Parry’s article implies, is to get PokerStars in the mix. Once Amaya Gaming bought PokerStars this summer, it seemed like PokerStars’ licensing approval was zooming right along, but Stars is still on the outside looking in. All signs were pointing to PokerStars getting licensed and going live by the end of this year; now Rebuck says it will be early 2015 at best. To some, it may seem like PokerStars’ entry would just fragment the New Jersey market further, potentially reducing traffic at individual poker rooms. The hope, though, is that PokerStars huge name will actually grow the market, as potential poker players who have been sitting on the sidelines will feel confident testing the waters once an established, familiar name like PokerStars goes live. There are likely many former PokerStars customers in New Jersey who have yet to go back to online poker, but may do so when they have their old friend back.

Even though the second year of online gambling in New Jersey will not come close to generating $1 billion, there is a good chance it will be better than the first. Geolocation inaccuracies were a problem at the outset, preventing players from signing up and logging on, something that naturally held down revenue. Some problems still exist, but they are fairly minimal at this point. Hopefully the DGE can convince more banks to process credit card transactions, as well, making it easier for players to deposit.

COMMENTS