MGM Resorts International Sells Bellagio and Circus Circus for a Combined $5 Billion

Confirming industry rumblings from a month ago, MGM Resorts International announced this week that it has agreed to sell both the Bellagio and Circus Circus casinos on the Las Vegas Strip. The sales took place in two separate transactions: the former to a joint venture created with Blackstone Real Estate Income Trust and the latter to Phil Ruffin. The combined sales price of both properties is more than $5 billion.

Bellagio

The Bellagio is arguably the Strip casino that people most identify with Las Vegas. It is one of the most luxurious and its fountains facing the Strip (Las Vegas Blvd.) have become iconic in pop culture. It sits on a perch in the poker world that few can approach. The famed “Big Game” is held in Bobby’s Room and the casino serves as host to the WPT Five Diamond World Poker Classic and many other poker festivals such as the Bellagio Cup.

In the opening paragraph, we said the Bellagio was sold to a joint venture between MGM and Blackstone. Let us elaborate. The joint venture is owned mostly by Blackstone – MGM has only a five percent equity stake. MGM Resorts International sold the Bellagio to said joint venture for $4.25 billion.

MGM Resorts will continue to operate the property, however, so the everyday experience for visitors likely won’t change. For the privilege, MGM (more specifically, a subsidiary of MGM) will rent the Bellagio from the joint venture for $245 million per year.

Jim Murren, Chairman and CEO of MGM Resorts International, said of the deal:

This transaction confirms the premium value of our owned real estate assets, highlights the unique value of Bellagio as a premier asset in gaming and solidifies our status as a premier operator of gaming and entertainment properties. We will use the proceeds from this transaction, together with the proceeds from the pending sale of Circus Circus Las Vegas, to build a fortress balance sheet and return capital to shareholders. By the end of 2020 we intend to have domestic net financial leverage at our operating properties of approximately 1x.

Image: David Stanley via Flickr

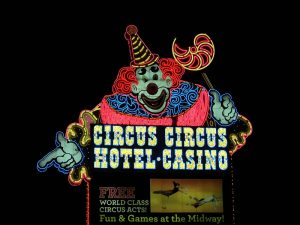

Circus Circus

Circus Circus is one of the oldest casinos on the Las Vegas Strip, celebrating the 51st anniversary of its grand opening on Friday. It is billed as the “largest permanent big top in the world” and its Lucky the Clown electronic sign is instantly recognizable. Located on the less popular north end of the Strip, Circus Circus falls distinctly into the “budget” category of Vegas hotels.

The property, along with its adjacent 10-acre RV park and 37-acre festival grounds was sold to Phil Ruffin, owner of the Treasure Island casino, which he also acquired from MGM. Ruffin is also 50 percent owner of Trump International in Las Vegas.

Ruffin paid $825 million for Circus Circus, split into $662.5 million in cash and $162.5 in a note due in 2024.

Ruffin sees the already successful Circus Circus as a property with even more potential. Talking to the Las Vegas Review-Journal, he noted that one of the attractive things about it is its upcoming neighbors. To its south will be Resorts World, opening next year. Drew Las Vegas is underway across Las Vegas Boulevard and the Las Vegas Convention Center expansion is under construction.

“Traffic’s going to increase,” Ruffin said. “The north side is coming alive.”

Ruffin said he will make changes to the Slots of Fun casino and will remodel the 3,767 hotel rooms. The RV park may be on the chopping block. He might also convert the festival grounds into an entertainment venue. He plans on keeping Circus Circus an affordable stay.

As for MGM, it stated its goal in a press release:

MGM Resorts’ commitment to its asset-light strategy is the culmination of an extensive strategic review of the interplay of its real estate portfolio, overall valuation and operational potential. This strategy is expected to unlock the significant unrealized value of the Company’s real estate and highlight the strength of its operating business. MGM Resorts is evolving its business model away from primarily a capital intensive, brick & mortar real estate business towards a developer, manager and operator of leading gaming, hospitality and entertainment properties. This strategy is designed to accelerate the Company’s top line growth, enhance its return on investment profile and result in a more financially robust, global enterprise that is best positioned to take advantage of future growth opportunities.

One of those growth opportunities is in Japan, where MGM is fighting to get one of the three available gaming licenses in the country. It has plans to build a $10 billion casino, which is why it needs the new influx of cash.

MGM Resorts International now only wholly owns two casinos: MGM Grand and MGM Springfield. That tidbit is slightly misleading, though. Yes, the company only owns those two casinos, but MGM Growth Properties, a separate company created by MGM, owns a baker’s dozen casinos, including Mandalay Bay, Excalibur, Luxor, The Mirage, and New York New York in Las Vegas, as well as the Borgata and MGM National Harbor.

COMMENTS