Lock Poker Issues Continue as Site Pros Dump Funds

The perception of liquidity problems and general malaise at Lock Poker shows no sign of easing up. The latest developments include a couple of the site’s pros looking to dump some of their online Lock funds at deep discounts, even below the already-deep-discounted rate in third-party marketplaces.

The perception of liquidity problems and general malaise at Lock Poker shows no sign of easing up. The latest developments include a couple of the site’s pros looking to dump some of their online Lock funds at deep discounts, even below the already-deep-discounted rate in third-party marketplaces.

The two Lock pros, Greg “HokieGreg” Tiller and Jared Hubbard, both sought to dump significant Lock bankrolls on 2+2. Both were asking only 33 cents on the dollar, for $10,000 worth of Lock dollars for Tiller, and $25,000 for Hubbard.

In roughly the same timeframe, a third Lock pro, Jeff “Duralast” Romano, tired to raise funds for a WSOP Main Event $10,000 entry by selling pieces of himself at $1.30 : $1, with the express directive that he wasn’t accepting Lock funds from his backers. That latter is the same thing prominent Lock pro Melanie Weisner tried a couple of months ago, with Romano receiving the same blasting Weisner did when she tried it earlier. Romano quickly abandoned the effort, with the 2+2 thread in which he asked for backers quickly being blocked.

As for Tiller and Hubbard, the most curious thing about their selling offers was that their asking price of $0.33 / $1 was a full nickel below the general level of Lock dollars on poker forums, which has hovered around $0.38 per dollar in recent days. Hubbard hasn’t promoted Lock for a couple of weeks on his Twitter feed, but Tiller was doing his best right up through June 26, the same day he sought to dump the $10K:

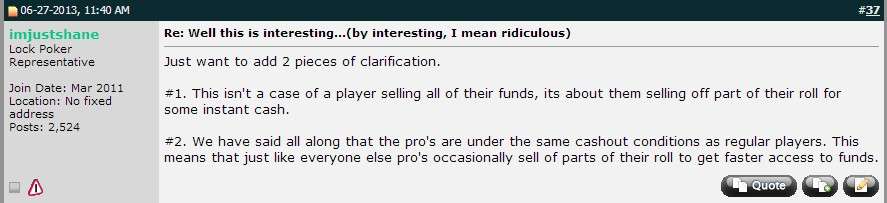

As expected, the whole thing kicked off a fresh round of player protests directed at Lock, where cashout times have failed to improve in recent weeks despite assurances from the site that improvements would be taking place. Lock Poker’s designated PR rep, Shane Bridges, even stopped by to drop a post into the discussion that was the equivalent of pouring gasoline on the player-complaint bonfire. Wrote Bridges:

See, that’s where it gets interesting. As pointed out by many observers, including Todd “Dan Druff” Witteles in this PokerFraudAlert.com thread, Bridges’ comments represented an about-face from the company’s stance back in early May, when Lock accused players and affiliates of driving down the secondary market and taking advantage of Lock’s own internal system to receive preferential (and unfair) cashout priority. Here’s a link to one of several pieces we did on the Lock situation when the company’s problems first reached the boil-over point.

Meanwhile, in the above thread, Bridges appeared repeatedly to defend Lock’s cashout practices, which included bumping a handful of smaller payouts ahead of larger ones that have been waiting for more than six months, and giving preferential treatment to customers of another poker forum which still heavily promotes Lock — both done purely in the interests of trying to create isolated pockets of positive customer perception.

Yet the silliness of it all is plainly evident: It doesn’t make sense that Lock’s own pros can undermine the going market rate in trying to sell off their funds, when other players and affiliates were publicly assailed by Lock earlier (part of a situation which Lock claims contributed to the site’s blocking of player-to-player transfer capabilities) for doing the exact same thing.

Meanwhile, the cashout trickle at Lock continues. A separate thread at 4 has tracked the combined US and rest-of-world cashouts as reported by the site’s players, with the totals of reported successful cashouts (cash or e-transfer) as of a day or two ago for the last three months as follows:

April: approx. 70

May: approx. 60

June: 34

While 2+2 does not represent the totality of Lock players (or even a majority), the troubling nature of the decline again indicates a severe lack of liquidity. We haven’t recommended playing at Lock for quite some time, and we continue to assert that at this point in time, almost any other site is a safer bet.

COMMENTS